Friends, if you also want to take a personal loan and do not understand how to take a loan and from where. How to get a personal loan? How to get online loan sitting at home? So in this post today we will know all this.

Friends, we all need money, when some day comes that we do not have money. And in such times we need loan. But taking loan from bank is like teddy pudding.

There is no easy loan available. Even if you get it, it takes a lot of time.

But there is nothing to worry, today we will give you information about how to get a loan sitting at home online. We will tell how you can take a personal loan from the app.

Read Also : How to take Personal Loan from KreditBee | KreditBee App Se Loan Kaise Le

Yes friends heard it right.

In this post we will talk about how to take online personal loan through app?

Today we will tell you about an app that gives personal loan sitting at home.

And the name of that app is SmartCoin instant personal loan app

Today we will learn about how to take a personal loan from SmartCoin app.

What do we learn about SmartCoin Instant Personal Loan App?

What we will know in this post today.

What is Smart Coin Instant Personal Loan App?

How to take loan with SmartCoin Instant Personal Loan App?

SmartCoin Loan details in hindi, which documents are required to take loan from SmartCoin Instant Personal Loan App, how long does it take to get loan from SmartCoin Instant Personal Loan App, how to apply SmartCoin loan and SmartCoin Loan App how much % interest loan gives.

We will discuss all these things in the post and understand in detail.

Let’s start how to take a personal loan from SmartCoin app.

[APK] Download Paytm Bank Agent App v4.8.7 (Update) Paytm BC Agent App New Version

UCO Bank CSP Registration Online Apply UCO Bank CSP Online

App Publish to Google Play Store | How to Publish App in Google Play Store

What is SmartCoin Instant Personal Loan App?

SmartCoin is an instant personal loan app. Through which you can take loan from mobile sitting at home.

Whatever loan you take through this app, it is available only from any NBFC / Bank which is registered with RBI.

Meaning it connects the borrowers to the banks. The loan you get from here is absolutely secure.

How much loan is available with SmartCoin Loan App?

If you want to take a loan from Smart Coin Instant Personal Loan App, then you should know that with Smart Coin app you can get loan from 4000 to 1 lakh sitting at home in no time.

And if this loan is approved, then at most it gets transferred to your bank account within a day.

For how long can one get the loan from Smart Coin Instant Personal Loan App?

If you are also thinking of taking a loan from SmartCoin app, then it is also important for you to know when to return the loan. and how to do it.

How much time do we get to pay back the loan? These things are very important to know.

Friends, the longer we repay the loan, the more we have to pay the interest on the loan.

So for this, before taking a loan, it is important to know that how much time is available to repay the loan.

So friends get from the Smart Coin loan app for 62 days to 1 year .

You have to repay the loan within this time.

How much interest do you have to pay on loan from Smart Coin app?

Like friends, before taking a loan, we should know in how much time we have to return it, in the same way we should also know how much interest will have to be paid on the loan.

The app from which we are taking loan gives loan at what percentage of interest.

So friends, you have to pay 0%-30% interest i.e. interest on the loan you get from Smart Coin Loan App .

What is required to take loan from Smart Coin Instant Personal Loan app?

- your being an Indian citizen

- Your age should be between 18 to 46 years

- You should have a legal fixed income every month

- Address proof must be

Which documents are required to take loan from Smart Coin?

- The first document you need to take a loan from here is an address proof. So you should have a basis for this.

- Then you should have another important document which is PAN Card. Yes friends, you also need PAN to take loan from SmartCoin app.

- And with these two documents, you should also have a bank account. In which the company will give your loan money.

Benefits of taking a loan from Smart Coin Instant Personal Loan?

- No credit history is required to take loan from here.

- Whatever process you have to take a loan, it is a complete online digital process.

- You do not need to go anywhere, you will get online loan sitting at home.

- If you are an Indian citizen then you can take loan from anywhere in India.

- After the loan is approved, the money is immediately credited to your bank account.

- 24 hours customer care service is available

- Interest rate is also fine, not high.

How to take Personal Loan with Smart Coin App?

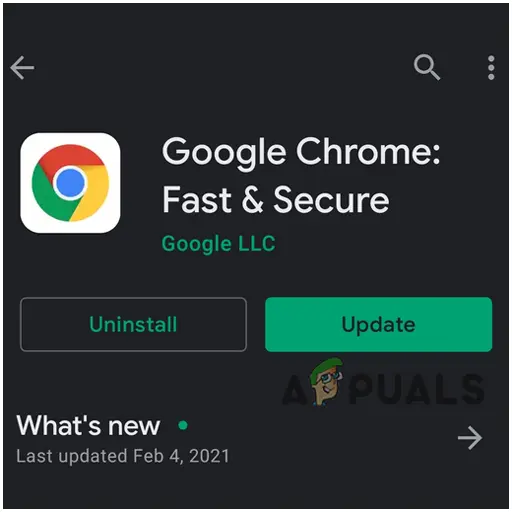

- First go to PlayStore

- There, type Smart Coin Instant Personal Loan and download

- After download register with your mobile number

- After that choose your loan amount

- Now fill your basic information in it

- Upload your documents like Aadhar and PAN card

- add your bank account

- Now after your loan is approved, the loan will come in your account

Smart Coin Loan App Review

If you also have to take an instant personal loan, then this app can be very good for you because with the help of this app you can take online instant personal loan from home that too up to 1 lakh.

Talking about Smart Coin Loan App Review, so far this app has a rating of 4.4 on Google Play Store . Which is fine.

And so far more than 50 lakh people have downloaded and file size 20MB. Meaning they have more than 50 lakh customers with Smart Coin app. Which is quite a lot.

What is Smart Coin Instant Personal Loan App Customer Care Number?

SmartCoin Loan Apply Now

Email : contact@smartcoin.co.in

Phone : +91 9148380504

conclusion

In this post, we have learned about Smart Coin Instant Personal Loan app Se Loan Kaise Le, which documents are required to take loan from Smart Coin Instant Personal Loan app, how much interest do you get from Smart Coin Instant Personal Loan App, How much loan is available with Smart Coin Instant Personal Loan App.

So if you also need an instant personal loan, then you can also take a personal loan from this app. Which comes in your account in no time.

If you liked the post then don’t forget to share it with your friends. And if you have any question, then we tell in the comment box below.

FAQ’s

How much loan is available with Smart Coin Instant Personal Loan App?

With Smart Coin Instant Personal Loan App, personal loans ranging from 4000 to 1 lakh are available.

Is Smart Coin a safe company?

Yes it is absolutely safe company. From here you can easily take a loan.